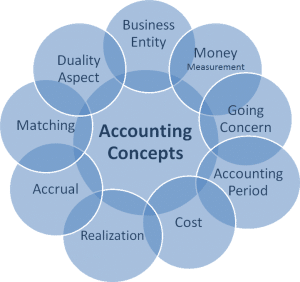

ACCOUNTING CONCEPTS

The concepts of accounting are the foundational principles and guidelines that govern how financial transactions are recorded, reported, and interpreted. These concepts ensure consistency, reliability, and transparency in financial reporting. These accounting concepts guide the preparation of financial statements and ensure they provide a true and fair view of a business's financial performance and position. By adhering to these principles, businesses ensure transparency, consistency, and reliability in their financial reporting, which is essential for decision-making by investors, creditors, and other stakeholders.

Here are the main accounting concepts:

1. Entity Concept

- Definition: This concept states that the business is a separate entity from its owners or shareholders.

- Implication: Financial transactions of the business must be recorded separately from the personal transactions of the owners.

2. Going Concern Concept

- Definition: This concept assumes that a business will continue its operations for the foreseeable future unless there is evidence to the contrary.

- Implication: Assets are valued on the assumption that the business will continue to operate and not liquidate in the near term.

3. Accrual Concept

- Definition: Revenues and expenses should be recognized when they occur, regardless of when cash transactions take place.

- Implication: For example, sales are recorded when the sale occurs, not when payment is received, and expenses are recorded when incurred, not when paid.

4. Matching Concept

- Definition: This concept requires that expenses be matched with the revenues they help generate within the same accounting period.

- Implication: For example, if a company incurs advertising costs to generate sales in a particular period, those costs must be recorded in the same period as the revenue from the sales.

5. Consistency Concept

- Definition: Once an accounting method is adopted, it should be used consistently from one period to another.

- Implication: If an accounting method needs to be changed, the reason should be disclosed, and the impact of the change should be explained.

6. Conservatism Concept

- Definition: This principle states that when choosing between two accounting treatments, the one that results in lower profits and asset values should be chosen, especially when there is uncertainty.

- Implication: It is better to understate than overstate the financial performance or position, reducing the risk of overstating assets or income.

7. Materiality Concept

- Definition: This concept allows accountants to disregard minor discrepancies or issues that would not influence the decision-making process of users of the financial statements.

- Implication: If the impact of an item is immaterial (not significant), it does not need to be treated according to formal accounting rules.

8. Monetary Unit Concept

- Definition: This principle assumes that transactions can be recorded in terms of a stable currency, ignoring inflation or deflation.

- Implication: All financial transactions are recorded in terms of a standard monetary unit (e.g., U.S. dollar, euro) and do not reflect changes in the purchasing power of money.

9. Time Period Concept

- Definition: This principle states that a business's financial performance and position should be reported for specific, consistent time periods (such as monthly, quarterly, or annually).

- Implication: Financial statements should reflect the financial results of the business for a particular period, allowing for comparison and analysis.

10. Realization Concept

- Definition: This concept holds that revenue should be recognized when it is earned, regardless of whether cash has been received.

- Implication: Revenue is recognized when goods are delivered or services are rendered, not when the cash is received.

11. Prudence Concept

- Definition: This concept suggests that accountants should not overestimate revenue or assets and should be cautious in recognizing profits and gains.

- Implication: This concept guides accountants to recognize potential losses as soon as they are anticipated but wait until revenue is actually earned before recognizing it.

12. Full Disclosure Concept

- Definition: All information that affects the financial position and performance of a business must be disclosed in the financial statements or in the accompanying notes.

- Implication: If there is any information that could influence the users' understanding of the financial position of a company, it must be fully disclosed.

| Tags: | #best accounting services in chandigarh, #best foreign accounting services in chandigarh , #best australia accounting services, #top foreign accounting firms in chandigarh |